The likes of Hearn have bought into the vision, however, while the schedule has also been leavened with the acquisition of rights to a rematch between YouTube influencers KSI and Logan Paul at Los Angeles’ Staples Center in November. Matchroom Boxing was the starting point of DAZN's US launch “It’s tough work,” chuckles Skipper at the thought of arranging that calendar, “because it’s not a sport that’s used to being organised.” The goal is to target “people used to paying 40, 60, even 80 bucks to watch a fight” and encourage them to spend US$19.99 a month instead for a season of regular boxing events through the autumn and winter. Mexican icon Saul ‘Canelo’ Alvarez was signed to a five-year, 11-fight agreement worth US$365 million last October, while his rival Gennady Golovkin was tied to a nine-figure, six-fight deal in March. It began with a comprehensive eight-year deal in May 2018 with Eddie Hearn’s Matchroom Boxing, whose rich stable of fighters includes former world heavyweight champion Anthony Joshua, that will be worth as much as US$1 billion. HBO and Showtime’s core business is entertainment they didn’t have omnibus contracts that gave them all the content.”ĭAZN set about putting together a schedule of top-level cards. “It was overwhelmingly a pay-per-view sport controlled by HBO and Showtime. “Boxing is not really controlled by the big US media companies,” Skipper says. That meant moving the market in a different way. The difficulty in finding a place in Skipper’s homeland was that “the big leagues are mostly tied up for a long time with someone, either ESPN or NBC Sports or CBS, Turner or Fox”. We felt like we needed to establish our brand in the United States because it takes a long time to build a brand there “The US does account for 28 per cent of all global consumption of sports, so it just felt like you’ve got to get started in the US.”

“We felt like we needed to establish our brand in the United States because it takes a long time to build a brand in the United States,” Skipper says. More than anything, though, they are built on the acquisition of premium rights – with one “anomalous” exception. “We launched in Germany and Japan in ’16, Canada in ’17, Italy and the United States in ’18, Brazil and Spain in ’19,” he says, “because the timing was such that we could get enough content to launch.”Īs for any OTT provider, those channels have demanded a substantial technical undertaking – DAZN Canada’s performance in year one, which had been glitchy for some users, has been improved by investment in higher-quality feeds and dedicated compatibility encodes. Though he does not offer specific comment on future target markets, Skipper notes that each DAZN arrival to date has been “sequential”.

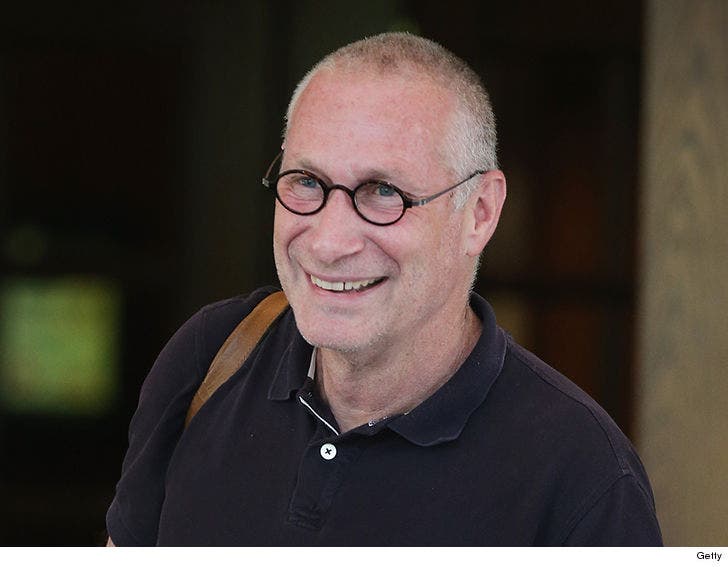

You really have to build the product around must-have, must-see content.”ĭespite not having a channel in those territories, DAZN currently holds rights to Uefa Champions League soccer in Thailand, Laos, Cambodia, Taiwan, Singapore, Malaysia, Brunei and the Philippines, something which could provide impetus for further Asian expansion. We do believe that to get people to subscribe, you have to have content that really matters, whether that be Serie A in Italy, whether that be MotoGP in Spain, Bundesliga in Germany, J-League in Japan, fights in the US, NFL in Canada. “We don’t, at the moment, have a global product. “Each of our local products is distinct and specifically intended to drive our business in Japan or our business in Italy,” says Skipper. While the “lodestar” for DAZN as a company is to be “the global leader in over-the-top sports streaming services”, offering a “new, more high-value, interactive way that you watch”, each national operation has to offer what local fans want. Launched in 2016, DAZN is now operational in Japan, Germany, Austria, Switzerland, Italy, Spain, Brazil, Canada and the US. We think locally about: what are the rights? How do we want to market? Who do we want to have as local ambassadors? How do we want to sell ads locally?” “At the London headquarters, we think about the overall brand promise and what our company values are, what our mission is. The technological platform is going to be overwhelmingly global. “Ultimately, the rights business is a local business,” says John Skipper, executive chairman at DAZN, “though we will put an overlay of international rights on top of that, eventually,” Skipper says. That creates twin challenges at the heart of the DAZN operation. According to executive chairman John Skipper, the former ESPN president who joined in May of last year, it wants to be the “leading global streaming service” for sport.

0 kommentar(er)

0 kommentar(er)